For wealthy individuals, deciding whether to finance an iPhone goes beyond just how much it costs. It involves strategic thinking about opportunity costs, credit use, and how it fits their lifestyle. More than just “zero-interest” promotions, this choice shows a deeper financial reasoning that appeals to people who want to make the most of their money.

The Hidden Cost of “Free” Credit

Installments without interest come with unexpected expenses. They create a dilemma: either commit funds to items that lose value or seek better investments. Affluent people might generate annual returns of 8-12% (or \(240-\)360 over two years) by investing $1,500 in private equity or high-yield bonds instead of a smartphone plan. Even ETFs that offer 5% dividends outperform “savings from interest.” The true expense lies in the profits that could have been earned—installment plans decrease in worth unless the purchased item (like a creator’s iPhone) produces revenue.

Credit Engineering for Elite Profiles

Payments made in installments can quietly influence the credit of individuals with high incomes. Making payments on time helps to enhance credit history, which is essential for obtaining significant loans. Having a balance of \(1,500 on a \(50,000 limit has little effect on the credit utilization ratio. It's more beneficial when plans from companies (like the Apple Card) are reported as “installment loans,” which can diversify credit types and could improve credit scores. Recognizing this information can improve one’s financial situation in more challenging credit scenarios.

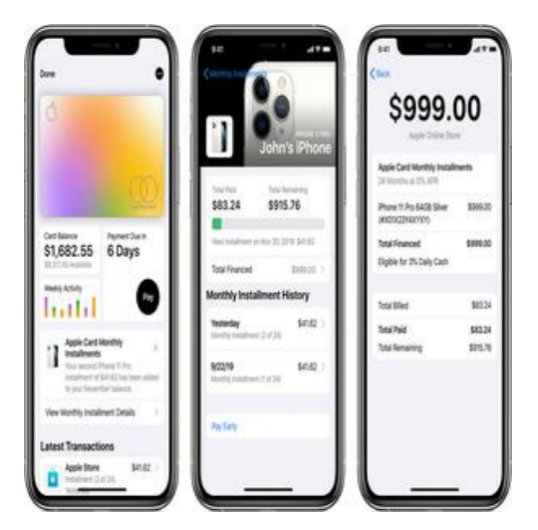

Brand Perks Beyond Payments

Top brands connect payment plans to added benefits. For instance, Apple provides 6% cashback for the Apple Store, which equals a $90 discount on phones, along with chances for early upgrades after 12 payments. This approach makes plans feel more like subscriptions, perfect for those who upgrade each year. High-end cards offer extended warranties or theft coverage, boosting value beyond what is usually advertised.

Liquidity vs. Lifestyle Signaling

For wealthy buyers, having cash on hand is essential. Holding $1,500 in cash or in an easily-accessible account allows for quick action on urgent chances—like a surprise art auction, the launch of a rare watch, or a short-term investment opportunity. By paying in installments, one can maintain this flexibility, converting a large purchase into smaller monthly payments. On the other hand, paying the full amount upfront may demonstrate financial wisdom to wealth managers, who often see it as a sign of good money management. The decision depends on whether instant access to cash or the appearance of financial responsibility is more important in someone's financial situation.

The Psychology of Micro-Optimization

Individuals with significant wealth often excel in making small yet impactful financial adjustments, and financing a phone aligns perfectly with this approach. By splitting payments into manageable monthly sums of $62.50, one can create an accurate budget that fits within wider financial goals, such as matching up with dividend schedules or bonus payments. This method also adds a mental barrier to spur-of-the-moment purchases; opting to cancel a payment plan requires more thought than simply using a card for a new gadget. For those who prioritize thoughtful spending, this systematic method encourages careful consumption, even for minor items.

Ultimately, financing an iPhone transcends mere affordability and focuses more on integrating with overall financial strategies. For wealthy individuals, it involves weighing opportunity costs, managing credit wisely, and meeting lifestyle demands—demonstrating that even seemingly minor financial choices reveal broader wealth management trends.