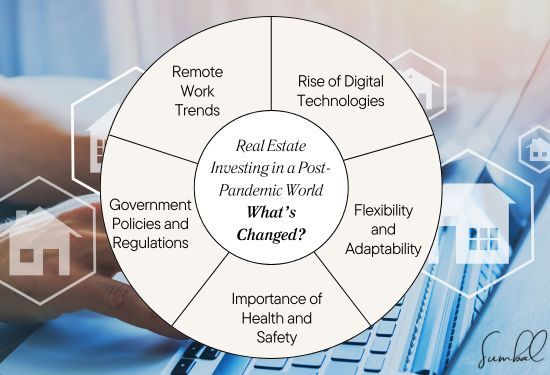

Real estate has been particularly affected by the COVID-19 epidemic. While the world adapts to post-COVID-19, investors face several opportunities and challenges. Thus, everyone who aims to invest in real estate or who wants to increase his market share in the real estate business must understand these dynamics.

Post-Epidemic Real Estate Market Opportunities

Rising Interest in Residential Real Estate

The business and home-life perspectives have changed due to the pandemic. As working from home has also become the trend, there has been a strong propensity for buying more spacious houses in the suburbs that accommodate office space for work and living space for the family. Investors must pay special attention to the properties in such areas and build spaces such as home offices and outdoor areas.

The Rise of Rental Properties

Although many avoided homeownership for the first time during the pandemic, they now opt to rent. This has led to the development of a healthy rental market, especially in the towns that show signs that people are returning to work. Purchasing residential rental properties such as multi-family units or single homes is ideal since demand is high and job opportunities are increasing in certain key areas, but home supply is limited.

Opportunities in Commercial Real Estate

E-commerce is boosted by the pandemic, which sharply affected retail sales volumes and changed commercial real estate, especially in towns. Logistics and industrial properties, in connection with the growth of online selling, are also good areas for investors. Furthermore, transforming underutilized retail areas into multi-functional commercial complexes could generate new activity cores in communities while delivering reasonable returns on investments.

Emphasis on Health and Wellness

COVID-19 has made people more sensitive to health, and facilities that incorporate these aspects are in high demand. Given the widespread trend of property investment, the value of residential and commercial properties can be increased further by applying health promotional measures, including air purification, green areas, and spas. As people focus on their health and well-being, properties that incorporate well-being into the design appeal more to buyers and tenants.

Post-pandemic real estate market challenges

Volatility of Market

The real estate market is still sensitive due to the instability of the growing economy. Any effects, such as inflation, fluctuations in interest rates, and feasible housing deficiency, may affect property prices. Investors must constantly monitor the market and the situation at the economic indicators level.

Regulatory Changes

There have been various regulatory changes since the pandemic, mainly relating to the protection of tenants and policies of homes. These regulations have to be tackled carefully to avoid violation, and the potential for good operation of the investment properties must also be achieved. Awareness helps prevent certain risks involving conflict with the tenant and various property management complications.

Supply Chain Disruptions

Due to the constant supply chain disruptions, construction schedules have been delayed in the development of the real estate. Those who wish to construct or retrofit houses, flats, and other structures may incur high costs and time costs. Such challenges face reasonable management through strategic planning and working with reliable contractors.

Changing Buyer Preferences

While the workplace is evolving to a more home-based structure, buyer preferences are also changing. This is because there are ever-growing demands from the tenants/ buyers that investors must serve by ensuring that properties meet their needs. Construction designs and functional uses of property should be flexible to meet changing market conditions.