Economic independence is sufficient flow of income, savings and inv

estment so that one can live comfortably, totally free from any paycheck. This only

comes with discipline, planning, and strategic steps. Hereafter are the steps towards your economic freedom which will walk you through easily on how to manage money, pay off outstanding debts, and invest properly for your future.

Step 1: Eliminate Debt with High Interest Rates

It may also block your way to money freedom. Credit card balances carry high

interest and have a propensity to balloon out very quickly if not watched over. These liabilities ought to be dealt with first: the quicker you pay off them, the more will be available for investment and saving.

Debt Payoff Strategies:

DebtAvalanche Method: Pay the loans with high interest. Next, pay the others with less interest. The money you save on interest will be substantial.

DebtSnowbalMethod: Pay the smallest loans first. Small wins build momentum and motivation. Then start tackling the big debts.

Consolidation of Debt:A person carrying high-interest debts may choose to consolidate them into a loan at a less interest rate.

Step 2: Save an Emergency Fund

We're talking about an emergency fund, which will help prevent those unwanted financial mishaps: losing a job or having a sudden medical emergency, or worse, your car breaking down. It serves like a buffer between you and debt if such

unwanted expenses are realized.

How to Build Your Emergency Fund:

Startsmal: Save at least $1,000 to get you going, then build it up to save for 3-6 months of living expenses.

Autopay savings: Use a high-yield savings account and have money automatically transferred from the checking account every month to make the saving habit easier.

Accessible yet nottoo liquid:Your emergency fund should be liquid, but accessible enough that you don't have temptation to dip into it for non-emergencies.

Step 3: Increase Your Income

Inasmuch as you do not want your expenses to balloon unnecessarily, an increase in your income can be another effective trigger that propels you toward achieving

financial freedom. This therefore involves seeking how to earn more money, whether through opening up a side hustle, career advancement, or passive income.

How to Increase Your Income:

Side Hustle: Freelancing, consulting, or making a business online can give you extra earnings.

Grow:The better you perform at work, the higher your wage increases will be.

Investin yourself:the more knowledge you gain or more skill-based certifications you earn, the more lucrative you become in the job market, and this ultimately leads to better income prospects.

Step4. Defend Your Wealth

Safety is always part of wealth creation. It includes risk management and proper safeguarding of hard-earned money. Protection of the wealth, therefore, is actually carrying out the correct insurances, estate planning, and legal protections.

Protect Your Wealth

Secureinsurance: Health, life, and disability insurance will all prevent loss in the

event of financial embarrassment. Insuring your place and car goes a long way in protecting your assets.

Develop an estate plan: Ensure that your assets are handed out as you wish in case of your death by drafting a will or setting up a trust.

Checkperiodicals: Review your insurance coverage and estate plans regularly because your financial situation is likely to change.

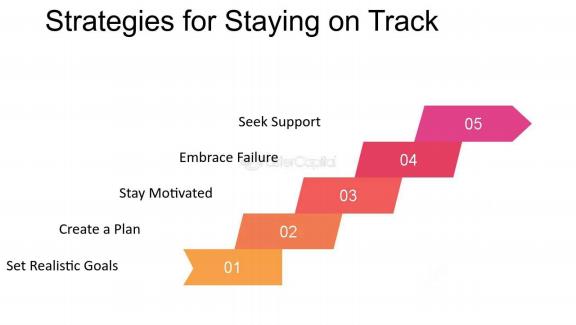

Step 5: Maintaining Discipline and Consistency

The only way to actually get out of keeping track of finances all the time is with

discipline-money budgeting, saving, and investments. Financial freedom does not happen overnight, but with commitment and perseverance, one will see his financial position improve.

Check-up to stay on Track:

Follow the progress by monitoring: how you are doing in terms of checking in on your goals and also budget and investment performance;

Celebratesmalwins: a milestone may be paid off credit card or you managed to save money up to some level-it keeps the engine running

Stay educated: continue to read books, listen to podcasts, or discuss matters with financial advisors so hone your strategies.

Conclusion:

Many things in life take time, especially if you have lesser to go with. Sometimes,

people dream to work overnight and wake up the next morning with a bank account full of money and financial freedom. In this regard, the term patience comes into play because to get financial freedom, careful planning, discipline, and consistent effort apply. Keep on being patient, keep on focusing and keep on doing all that is in your path while reminding your mind that every little step pushes you further to the

ultimate goal of absolute financial freedom.