For people who have a lot of money, changing from just keeping their wealth to making more money requires a significant change in thinking. Instead of just typical tips like “save more” or “invest smartly,” wealthy individuals adopt unique strategies that utilize their resources, connections, and willingness to take risks. This shift from a limited “saving” mindset to a more prosperous “money-making” attitude is essential for ongoing financial success.

Redefining Risk: From Avoidance to Calculated Leverage

Generally, people believe it is best to avoid risks, but those who are rich see risk as a way to grow. Instead of avoiding uncertain situations, they analyze them closely to find chances where the rewards can be greater than the potential losses. For instance, while investing in new markets or startups may appear risky, strategic thinkers evaluate important aspects like market needs, competition, and future growth opportunities.

Moreover, wealthy people use leverage effectively, not only in terms of money but also with how they use resources. They often collaborate with specialists or invest in skilled individuals, using their expertise and connections to promote growth. By taking this thoughtful approach to risk, they are able to venture beyond what feels safe and take advantage of possibilities that others might not see.

Network - Driven Wealth Creation

The affluent recognize the importance of their connections as significant resources. They purposely build relationships not only to enhance their social image but to create additional sources of income. By engaging with similar-minded peers, industry experts, and innovators, they unlock access to unique investment prospects, partnerships, and confidential insights.

For example, attending exclusive networking functions or becoming a member of private investment groups can lead to opportunities in various fields like private equity, real estate, or technology. Furthermore, these connections provide a venue for exchanging ideas and working together on projects, resulting in wealth-building initiatives that benefit everyone involved. Effectively utilizing these relationships is vital for moving from being a passive saver to becoming an active creator of wealth.

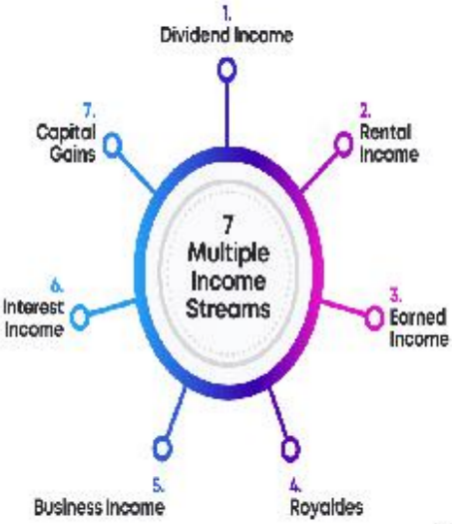

Embracing Multi - Dimensional Income Streams

Wealthy people do not depend on just one source of income; instead, they spread their investments across various avenues. They put their money into different assets, which might include stocks, bonds, real estate, and unique options like art or cryptocurrency. Their methods for earning money extend beyond simple investments.Many individuals with high net worth establish their own businesses or create intellectual properties, including writing books, developing software, or offering online courses. These projects generate extra income while also having the chance to grow significantly. Additionally, they may look into revenue-sharing models, licensing deals, and affiliate programs, forming a network of income streams that collectively enhance their wealth.

The Power of Continuous Learning and Adaptation

Affluent people are always eager to learn. They keep themselves informed about market changes, advancements in technology, and new business concepts. This dedication to education helps them quickly adjust to new situations and discover fresh ways to make money.

Additionally, they often look for mentors and advisors who can offer valuable advice and perspectives. By connecting with knowledgeable experts, they gain an advantage in the marketplace. Whether it’s exploring new investment methods, grasping the latest marketing strategies, or examining creative business approaches, ongoing education is a crucial part of their growth-oriented mindset.For high-net-worth individuals, moving from saving to making money involves more than just increasing their earnings; it requires a mindset that accepts risks, uses networks effectively, diversifies income sources, and embraces continuous learning. By moving beyond conventional wealth management practices, these individuals establish a path for enduring financial success and personal satisfaction.