Collectors of luxury watches are transforming their private collections into sources of dual income. By lending out exclusive timepieces to upscale hotels to enhance guest experiences—bringing in between $2,000 and $5,000 each month—they establish a reliable cash flow. This revenue is then reinvested into shares of new watch brands, where initial investments in companies like F.P. Journe have appreciated by over 40% annually. The advantage of this approach is that the loan program offers valuable market insights that lead to more informed investment choices.

In a similar way, vintage car lovers are leasing their classic vehicles to movie studios, making between $15,000 and $30,000 per production. They use this money to buy fractional stakes in automotive technology startups. For instance, one collector’s 1963 Ferrari now supports 7% of a battery-swapping company, creating a cycle where income from physical assets fuels advancements in mobility technology.

Intellectual Capital Arbitrage

Ex-C-suite leaders are leveraging their knowledge by offering advisory services to startups for a fee, usually ranging from \(10k\) to \(25k\) each month, and are reinvesting that money into convertible notes of those startups. For example, a former Goldman Sachs director works part-time with fintech founders and reallocates 30% of her advisory income into equity stakes, achieving an average return of five times when her portfolio companies sell. Her extensive experience navigating regulatory challenges on Wall Street helps her identify promising business models early, converting advisory meetings into opportunities for due diligence.

Prominent interior designers take this concept even further; they charge over $50k for premium home consultations and allocate 20% of their earnings to support artisanal furniture makers whose work they endorse. This strategy forms a self-sustaining loop where their design services enhance demand for the brands they invest in, increasing both their cash flow and the value of their investments. A leading designer in New York, for instance, observed a 300% increase in the valuation of a ceramic artist after showcasing their work in five prominent projects within two years.

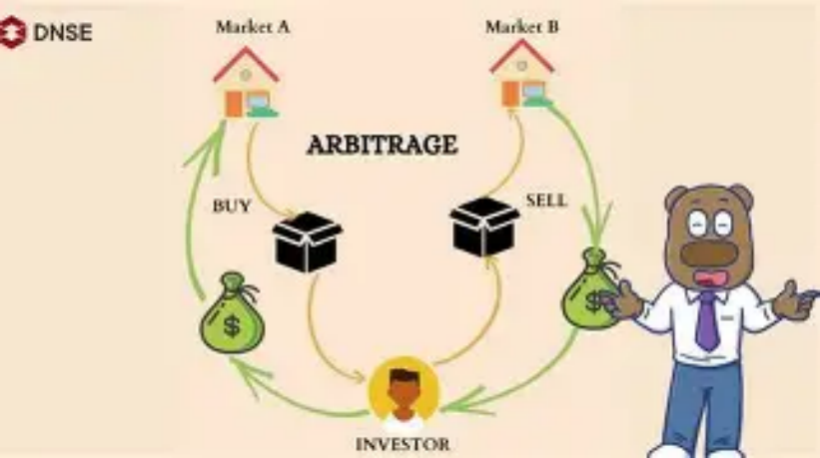

Exclusive Network Arbitrage

Members of private equity clubs are creating interconnected systems. By organizing quarterly investment summits, they not only earn immediate revenue but also uncover opportunities for their angel investments. One group based in Dubai funds two to three startups every year from attendees of these summits, with the entry fees covering 15% of their yearly investment budget. Moreover, these events serve as a means of evaluation, as the questions and involvement of attendees highlight which projects truly have market potential.

Similarly, wine experts use a comparable strategy. They hold exclusive tastings for small vineyards and then reinvest the profits to purchase futures of those same wines. A collector from Napa Valley finds that his events now cover 40% of his Bordeaux en primeur spending, transforming social events into profitable investment opportunities. His status as a connoisseur also allows him to secure rare vintages that are often out of reach for regular buyers, boosting his returns.

These models benefit from mutual reliance. The extra income functions not merely as an addition but as a way to gather insights for the investment side, while the investments increase the value of the assets or knowledge generating this income. For affluent individuals, this approach isn’t merely about diversifying; it aims to create a self-sustaining financial ecosystem where every revenue source supports and strengthens the others.