In the world of advanced investing, Exchange-Traded Funds (ETFs) have become valuable resources for wealthy individuals aiming to improve how they manage their investments. Unlike simple index funds, ETFs provide a wide range of creative strategies that can enhance the effectiveness and success of investment portfolios.

Tailored Factor-Based ETF Strategies

Wealthy investors can go further than just broad-market ETFs by utilizing factor-based ETFs to achieve particular objectives. Certain factors, such as value, growth, quality, and low volatility, have demonstrated the ability to outperform the market under specific circumstances. For instance, ETFs that focus on quality choose companies with dependable earnings, solid financials, and high return on equity (ROE), which helps provide stability during tough economic times.

By combining various factor-based ETFs, investors can tailor their risk-return profiles. They can allocate funds to value ETFs that focus on undervalued stocks while also including growth ETFs to capture new opportunities. This approach balances safety and potential for growth, allowing investors to express their distinct perspectives while ensuring they stay diversified.

Global and Cross-Asset ETF Portfolios

Wealthy investors have the chance to globally diversify their portfolio through ETFs, enabling them to invest in countries like Vietnam, Indonesia, and India, which enjoy growth from their demographics and technology.

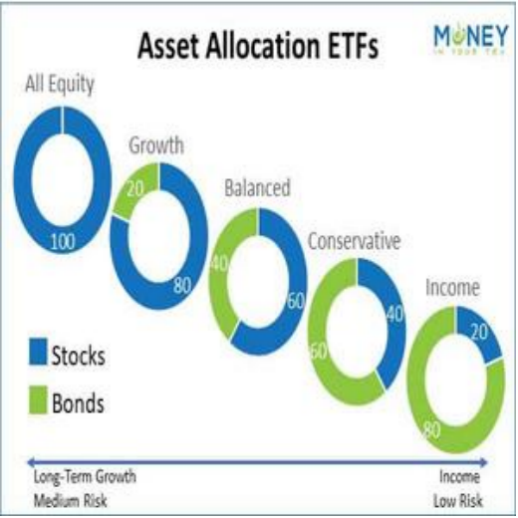

Additionally, using cross-asset ETF portfolios enhances investment strategies. By combining equity, fixed-income, real estate, and commodity ETFs, investors can create robust portfolios suited for different market conditions. When bond ETFs face challenges due to rising interest rates, gains from real estate or commodity ETFs can help cover those losses, reducing risks and allowing for various market opportunities.

Leveraged and Inverse ETFs for Strategic Hedging

Often neglected by beginner investors, leveraged and inverse ETFs can serve as formidable instruments for seasoned individuals with significant capital. These leveraged ETFs employ financial derivatives to boost the returns of a specific index, offering a chance for greater profits during a rising market. For instance, a 2x leveraged S&P 500 ETF seeks to achieve double the daily performance of the S&P 500 index. However, one must consider that using leverage can also significantly increase losses, which is why these ETFs are better suited for short-term trading strategies.

Conversely, inverse ETFs aim to take advantage of market downturns. They offer a method to protect against possible losses in an investment portfolio when market conditions are unstable. For example, if an investor expects a temporary drop in the technology sector, they might turn to an inverse technology ETF to help mitigate potential losses in a portfolio heavily invested in tech stocks. By wisely using leveraged and inverse ETFs, affluent investors can effectively navigate their risk levels and safeguard their investments in challenging market times.

Tax-Efficient Investing with ETFs

For wealthy individuals, it is crucial to manage taxes effectively when allocating assets, and exchange-traded funds (ETFs) outperform standard mutual funds in this area. Their distinct process of creation and redemption minimizes capital gains distributions, which allows for extended tax deferral and improved wealth accumulation.

Moreover, ETFs make it easier to engage in tax-loss harvesting. By selling ETFs that have lost value to counterbalance gains from other investments, overall tax liabilities decrease, which helps maintain returns and enhances portfolio performance after taxes are considered.In summary, the tax benefits of ETFs, combined with adaptable strategies such as factor-based investing and global diversification, make them an excellent choice for wealthy investors looking to optimize their portfolios and achieve long-term financial goals.