For wealthy families, preparing for a child's education involves much more than just saving money. It requires developing a thoughtful financial plan that matches worldwide education goals, takes advantage of special investment chances, and handles complicated financial situations. Let's look at how to carefully design your child's education fund in ways that surpass traditional ideas.

Global Education, Global Planning

Families with high spending often aim for elite international schools and universities. To achieve these goals, it's important to have a worldwide view of education planning. Rather than depending only on local savings options, think about creating offshore education trusts. These trusts can manage various assets such as international stocks, bonds, and properties in key education centers like London, Boston, or Sydney. Investing in real estate close to well-known schools not only offers the chance for property value growth but also provides housing for your child during their studies, which can lower living costs over time.

A creative way to enhance education planning is to combine it with strategies for citizenship and residency. Programs like investment-based citizenship or golden visas in countries with strong educational systems can offer multiple advantages. For example, securing residency in a European nation through investment might allow your child to attend top European universities with lower tuition fees while expanding your family's global presence.

Unconventional Investment Avenues

While traditional education savings accounts serve a purpose, affluent investors have the option to consider more advanced investment strategies. Opportunities in private equity and venture capital funds targeting the education technology (EdTech) landscape are particularly appealing. Investing in promising startups within the EdTech sector not only offers potential financial gains but also keeps you connected to advances in educational methods, enhancing your child's learning opportunities.Additionally, integrating art and collectible investments into education funding can be beneficial. High-value pieces, including rare wines, fine art, or vintage cars, often increase in value over the years. By carefully managing a collection as part of an education fund, you can create a significant financial asset that supports tuition, study abroad experiences, or further education after graduation.

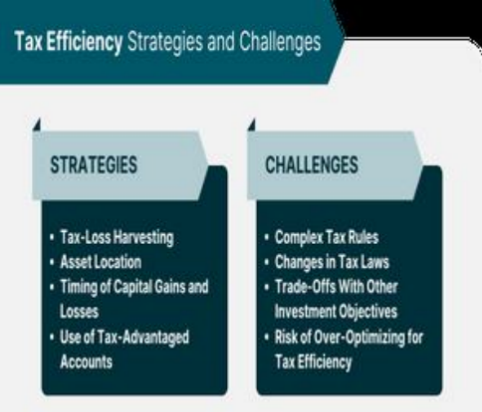

Tax - Efficient Strategies and Legal Frameworks

When planning for a child's education, optimizing taxes is very important. Those who earn a high income can take advantage of special education accounts that have tax benefits, like the 529 plans found in the United States. Moreover, making contributions to family foundations or educational charitable trusts can lead to meaningful tax reductions while also supporting education-related initiatives.

From a legal standpoint, creating family limited partnerships (FLPs) or limited liability companies (LLCs) for the education fund can offer protection for assets and maintain control. These legal structures help you manage the fund's assets effectively, decide on investments, and handle educational expenses in a clearer and more secure way.

Flexibility in the Face of Change

The world of education is always changing, and your plan for funding it should adapt accordingly. To ensure flexibility, you need to frequently reassess how your investments are distributed, taking into account current market trends and your child's evolving academic interests. For instance, if your child develops a keen interest in new areas like artificial intelligence or renewable energy, it would be wise to modify the fund's investments to facilitate access to appropriate educational experiences, such as specialized classes or research initiatives.Additionally, think about planning for unexpected events. It’s a good idea to set aside a contingency fund within your education savings to handle unforeseen costs, like cancellations of study-abroad programs, extra tutoring requirements, or shifts in educational standards due to new technologies.

In summary, strategically organizing your child's education fund for families with significant wealth involves multiple steps. By incorporating international viewpoints, investigating innovative investment options, enhancing tax benefits, and maintaining flexibility, you can build a strong financial base that not only supports but surpasses your child's educational aspirations.