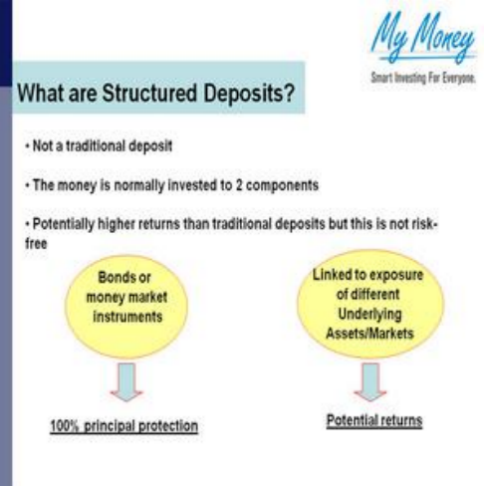

In finance, banks frequently offer structured deposits, which many investors find appealing. It is essential for wealthy individuals looking for consistent, yet possibly rewarding, investment options to determine if these products are genuinely advantageous or if they might lead to problems.

The Complex Mechanics Behind Structured Deposits

Structured deposits differ from standard bank savings products. Essentially, they merge traditional deposits and components based on derivatives. While banks may promote these options as offering greater returns compared to regular savings accounts, many investors do not grasp the complicated methods behind these returns.

These deposits are frequently tied to various underlying assets, including stock indices, commodities, or exchange rates. The way returns are calculated usually relies on a detailed formula that hinges on how these assets perform over a set timeframe. For instance, a structured deposit might guarantee a minimum return like that of a standard savings account if the linked asset remains within a certain range. However, if the asset hits specific target levels, the potential for higher returns arises. Unfortunately, the chances of receiving these elevated returns are often much lower than what is implied in marketing, based on intricate financial models that many investors find difficult to understand.

Hidden Risks Beneath the Surface

A lesser-known danger of structured deposits is their limited liquidity. In contrast to normal savings accounts, which allow for easy withdrawals with few penalties, structured deposits come with a set term. If you take out your money early, you might face hefty fees that could reduce a large part of your original amount. This restriction on access can be a significant issue, particularly for wealthy individuals who may require quick funds for different financial or business needs.

Additionally, there is a credit risk tied to the bank that issues the deposit. While structured deposits may appear to be a safe choice, their value could be jeopardized if the bank encounters financial problems. Some deposits might have partial protection through insurance schemes; however, this coverage may not include the full amount, especially when the structured part is viewed as a distinct investment rather than a standard deposit.

Bank Sales Tactics and Investor Awareness

Banks frequently employ advanced sales techniques to market structured deposits. They often describe these options as "safe" or "low-risk" investments, utilizing language and comparisons that might confuse potential investors. Sales agents tend to highlight the possibility of high returns while minimizing the risks involved. For affluent individuals, this lack of clarity can result in investments that do not match their financial aspirations or willingness to take risks.

Furthermore, many investors neglect to read and fully comprehend the product disclosure statements. These materials provide crucial information regarding the terms, risks, and possible returns of the products, yet they are usually cluttered with complicated financial language. Without a solid grasp of these statements, investors might unknowingly put themselves in risky situations.

In summary, structured deposits can neither be deemed a complete advantage nor an obvious danger. They may serve as a suitable investment for wealthy individuals who understand their intricate details and related risks and are ready to conduct thorough research. Conversely, for those enticed by the allure of high returns without a clear understanding of the mechanisms and risks involved, structured deposits can become a costly error. It is vital for investors to carefully consider these products, seek independent financial guidance, and meticulously review the details before making investment choices.