In the unstable world of international trade world, the fluctuations of the tax can turn a lucrative agreement in the night financial night. For the foreign commercial investment with significance investment, exchange coverage is not only a strategy - but it is a survival skill. All the bind of the use of the use of the available users, the term contracted as a powerful weapon but not made to protect profits. This guide gets in nuane strategies exceed High business bidding batch a sophisticated approach to handle the risks of exchange.

The Hidden Perils of Exchange Rate Volatility

Exchange rates are affected by complex network of economic factors, political and market. A sharp change in central bank policy, geopolitical tents or even a single economic relationship can send spiral monetary values. Review the case of luxury products that, after completing an Agreement with a European provider, saw Euro refused 8% of the payment date. That was originally planned as a 15% profit difference only at 7%, eating in results. These Unpredicted changes may have a composition effect on company, especially those who treat with great pounds and strict boundaries.

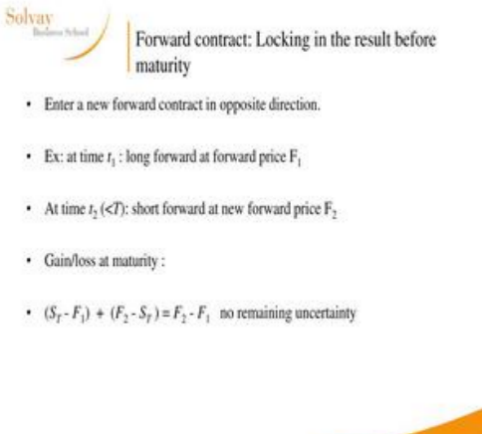

Decoding the Power of Forward Contracts

In the essence, time contracts are agreement to buy or sell a certain amount of coin with a default fee on a future date. But the real value is found in their flexibility and customization. Infected trades can specify the conditions in accordance with their commercial needs, as regulating the contractor to matte the future calendar to handle the money scrolling.

for example, instead of a standard monthly contract, a High volume export can choose a "scale contract structure." This involves the end of the contract with different appropriate dates, allowing the risk and benefit of the standing movements that favor on time. For diversifying contract, business, business wallet against the protection against the norm of different sfast while opportunity to achieve market fluctuations.

Advanced Strategies for Maximum Profit Protection

An innovative approach is to use the term "count" knock ". These contracts include a clause that ends agreement if the exchange reaches a certain level, leaving the traitor's traitor's traitor of the most favorable market. For example, a jewelry importer can define a level of support at 1.20 for USD-EUR pair. If the euro is weakened beyond this rate in front of the contractor the contract is automatically, allowing the importer to receive a currency The lower market rate.

Another strategy is the integration in the long-term contracts with options. By purchasing a currency option with a term contract, the traders can limit their risk of decline while maintaining growth of growth. This hybrid approach offers an additional layer of protection, especially in very secure market environments. For example, a textile exporter can buy a dollar sales option while completing a long -term contract to sell dollars, warranty A minimum exchange rate while able to enjoy if the dollar is enhanced.

Navigating the Pitfalls

However -term contracts long provides important advantages, are not without risks. Incorrect anticipation anticipate the future exchange rates of contract conditions can lead to the unexpected opportunities or losses. To mitigate these risks, senior traders often work with a financial expert team, including currency executives and risk leaders. These professionals use advanced modeling techniques and real market data to develop personalized cover strategies matching trader Specific targets and risk tolerance.

in the game with international trade issues are a natural trading instrument is a trade instrument and make a different company and a fight to stand in the sea. I understand the details of these contracts and implementing stories, the trailer engaged can block moved toil, our valleys in the unstable exchange.