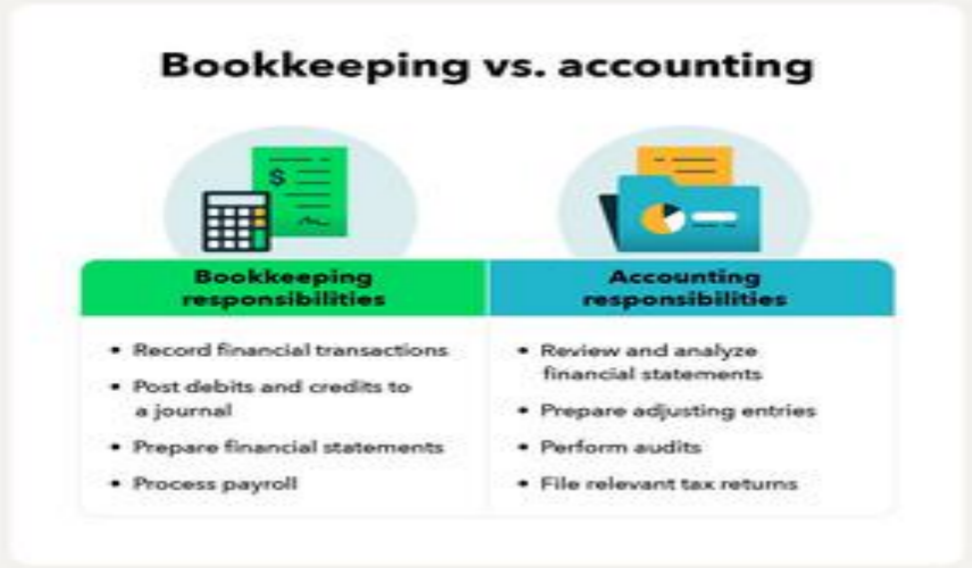

For people who have a lot of money to spend, bookkeeping may appear boring or unimportant. Yet, if you look more closely, you'll find it can be a strong tool that transforms how you handle money and change your future spending. Instead of just keeping an eye on costs, today’s bookkeeping, when approached with purpose, can reveal valuable information, reduce impulsive purchases, and help you make more thoughtful and lasting financial choices.

Unveiling Hidden Spending Patterns with Behavioral Economics

Bookkeeping goes beyond just handling numbers; it serves as a tool for encouraging awareness in spending. Keeping a record of each purchase helps you realize what you are giving up for every item. Wealthy buyers often overlook how easily they can buy luxury items, but bookkeeping encourages you to take a moment to reflect on the real cost and importance of each purchase.

This heightened awareness can change how you view spending. Rather than thoughtlessly collecting things, you might begin to value experiences, invest in your growth, or support causes that matter to you. By intentionally deciding where your money goes, you can change the path of your spending from simply acquiring goods to living with intention.

The Art of Data - Driven Financial Decision - Making

In today’s digital world, bookkeeping has changed into a practice filled with valuable information. People who spend a lot can use the details from their spending records to make smart financial choices. Rather than depending on instincts, you can review past spending data to find the best budget for various areas of your life, like travel, eating out, or shopping.

For example, if your records indicate that a large part of your income goes to international trips but you often find them difficult to enjoy due to limited time, you can shift how you spend in the future. By utilizing this information, you can set aside money for local experiences that fit your lifestyle and available time better. This data-based method allows you to manage your finances effectively and redirect your spending towards what is most important.

Cultivating a Mindful Consumption Mindset

Keeping track of finances goes beyond just dealing with figures; it plays a key role in fostering a thoughtful approach to spending. Writing down every purchase allows you to see the value being exchanged. Wealthy buyers might often overlook how easily they can purchase luxury items, but maintaining financial records encourages you to stop and reflect on the real cost and importance of what you buy.

This enhanced awareness can change how you view consumption. Rather than thoughtlessly gathering items, you may begin to value experiences, invest in your personal development, or support causes that matter to you. By making deliberate decisions about your spending, you can shift your path from merely collecting goods to living with intention.

Creating a Financial Roadmap for Long - Term Goals

For those who spend significantly and have ambitious financial ambitions, bookkeeping serves as the essential basis for developing a detailed financial plan. By examining your income, outgoings, and savings patterns over time, you can establish achievable goals for building wealth, investing, and preparing for retirement.

Take, for instance, the desire to buy a second home or support your child’s overseas education; your expense records can reveal spots where you may reduce spending or reallocate funds. Additionally, bookkeeping lets you monitor your advancement toward these objectives, facilitating necessary adjustments in your strategies. With a well-defined financial plan, you can make certain that your spending habits are in line with your future aspirations.

Bookkeeping is not merely about tracking expenses; it is a powerful method that brings significant changes. For wealthy individuals, it provides clarity on their financial habits, encourages informed decision-making, promotes thoughtful spending, and helps in reaching long-term financial objectives. By viewing bookkeeping as a strategic resource, you can reshape your financial narrative and create a wealthier, more satisfying financial future.