FWANC(AL

FWANC(AL

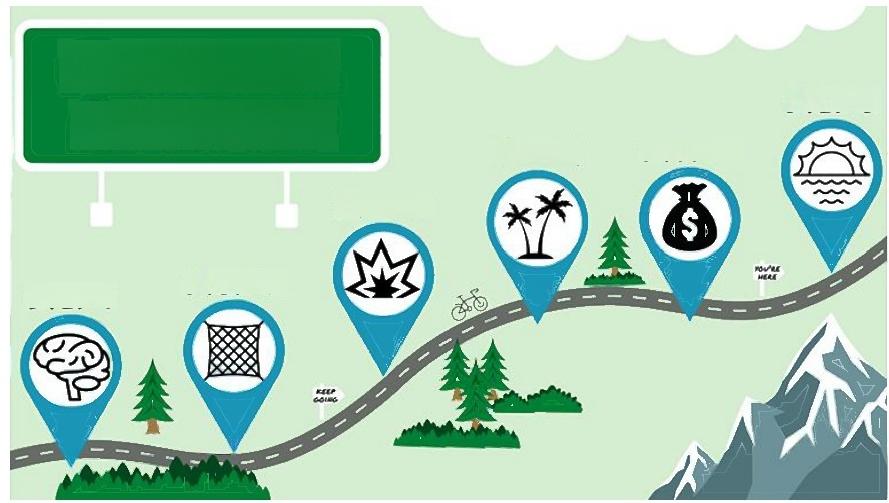

STEP 6

kOADMAP

STEP t STEP 5

STEP 3

STEP) sTEP 2

financial freedom the state of having enough savings,investing,and earning enough income for one to live life on his or her own terms but not necessarily according to

someone else's pay schedule. This kind of state is achieved

consciously with proper planning,smart saving,and wise investment know-how. Here is a simplified roadmap that assists you in trying to achieve your goal of

financial independence.

Step 1:Set Clear Financial Goals

Define for yourself what you believe financial independence is.Is it early retirement, traveling around the globe,or paying off debt?Clear,specific goals will help guide your financial decision-making.

How to Set Goals:

Be transparent:Identify transparent monetary objectives that can be doing

something such as saving $100,000 in five years,or paying off a mortgage in 10

years.

All those objectives should have a deadline.

Prioritization-High Priority: Decide what's most important to you, and put most of your energies there first.

Step 2: Budget

A budget is a must if you want to know where your money comes from or where it goes. This will surely let you know exactly what you spend your money on and have less than you make.

Budgeting Tips:

50/30/20 Rule: Set up 50% for basic needs, 30% for wants, and 20% for debt repayment and savings Moneytracking:To keep track of your spending, use budgeting apps like Mint or You Need a Budget (YNAB).

Regularly review your budget: Update it based on the change in income and/or expenditure

Step 3: Pay off High-Interest Debt

If you have debts that have relatively high interest, such as a credit card, you will be thousands of light years from financial independence freedom. You therefore need to save debt so that you can begin saving and later investing at a convenient future time.

Strategies to Repay Debts

DebtAvalanche:You start off with the debt which has the highest interest rates.

DebtSnowbal: It is when you start with the smallest debts to promptly get momentum.

DebtConsolidation: Several high-interest debt loans are combined together into a single loan at much lower interest and therefore easily repaid.

Step 4:Build an Emergency Fund

Your reserve is meant to act as a safety net.

Use it for unexpected events,such as a medical emergency,car breaking down,or even losing your job.This way,you will avoid debt when things did not go as

planned.

How to Save an Emergency Fund:

How to build an emergency fund

How to build an emergency fund

1.Set a$goal

2.Start small

3.Make automatic transfers

4.Manage expenses and spending 5.Avoid "lifestyle creep"

6.Gamify your savings

·Start with a small budget.

·Continue saving until you will have enough set aside for at least three to six months of living expenses.

·Automate savings:There must be automatic monthly transfers into your savings.

Step 5:Save and Invest for Long-Term Growth

If you start early enough,then your investment will definitely be growing with time because of the compounding effect.

Some Tips on Investments:

Maximize Contributions to Retirement Accounts:Use tax-deferred accounts like

401(k), IRA, and others available.

Diversify Your Portfolio: Invest across classes: equities, bonds, and real estate.

Low-Cost Index Funds:That's an extremely easy way to diversify and grow your investments over time which is perfect for beginners.

Step 6: Raise Your Income

Ensure that your trust specifies your desires about the disposition of your assets.

Sometimes it just calls for career advancement, side hustles, or perhaps the birth of a passive income stream. Take some time to think on how you could make more

money.

Increase Income Ways:

Side hustle:That could be freelancing, consultancy, or an online business.

Askfor more money: If you are raking well at work, you take your talent and get more value out of that job.

Investin yourself:Take courses and earn certifications that make you a more valuable member of society in the jobs market

Step 7:Protect Your Wealth

That wealth,though,has to be protected.This would include having good insurance coverage and also in estate planning in such a waythat your money is protected for the next generation.

Protect Your Wealth:

Getinsured: First and foremost,obtain good health,life,and property insurance.

Now,create an estate plan.Make sure your wishes for the distribution of your assets are spelled out in a will or trust.

Review Periodically:Occasionally review your insurance policies and estate plans

for updates to match the current financial situation.

Step 8: Stay Disciplined and Consistent

Patience, discipline, and consistency are some ways to achieving financial

independence. Tracing and following through on your budget and investments give you fewer tendencies to inflate your lifestyle as the income increases over time.

Stay the Course:

You track your financial goals and adjust the course of action.

Milestones appreciation: Reward the small wins, like paying off a credit card or sufficient savings for a down payment, to keep the motivation going.

Continuously educated: Read book, or financial planners to further learn.

Conclusion:

In reality, financial freedom is achieved through careful planning, disciplined

budgeting, strategic investing, and having a clear set of specific goals toward which your efforts can be directed-to pay off bad debt, create an emergency fund, invest for the future. So, keep up those small steps toward financial independence.